In Part I (link here), we started off on the road to “Integrated Business Planning” (IBP) by posing 5 fundamental questions that need to be answered in evolving a strategic supply chain road-map. Link to the article addressing the 1st question (Part II) is here.

In this article, let’s take a look at the 2nd question :

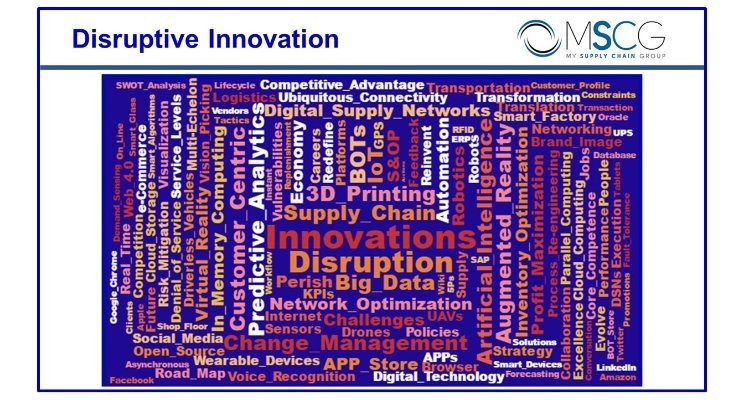

2. What are the key innovations of the recent past and the near future? These will help you evaluate the new tool-sets available to enhance the effectiveness of your supply chain planning & execution process. These innovations (some of them quite disruptive), will also help you understand future competitive challenges that you will face if you do not exploit them appropriately.

There are many rapidly evolving technologies and innovations with a significant impact on supply chains strategy, tactics and operations. Let’s look at broader themes of the innovations (in no particular order) over the past decade and those on the horizon whose full impact is still not very clear.

The 4th industrial revolution already under way is enabled by digital technology and ubiquitous connectivity. Digital manufacturing in the “smart factory” will be enabled by digital supply chains, automation, data exchange in cyber-physical systems, the Internet of Things (IoT), cloud computing and cloud storage. Distinction between hardware and software is giving way to integrated / aggregated “solutions” or “appliances” ranging from iPhone to even more affordable smartphones and tablets to wearable mobile platforms putting information at the fingertips, eyes and ears of billions.

Evolution of in-memory computing and columnar & row-based relational data base are enabling real-time integration of Big Data and Advanced Analytics with fault-tolerant algorithms for demand generation, multi-echelon inventory and network optimization as well as collaboration across the end-to-end Digital Supply Networks (DSN).

Usage of internet / world wide web has evolved in barely 2 decades from connecting information (Web 1.0) to people (Web 2,0) to knowledge (3.0) to intelligence (Web 4.0). The user-base of internet has expanded just as rapidly with connectivity quickly becoming a utility taken for granted. Networking has evolved from social networks (e.g., Facebook) to professional networks (e.g., LinkedIn, inter- and intra-company networks) to 140-character updates on twitter. Collaboration with apps that share text, data and media has evolved from Napster and file-sharing torrents to apps embedded within ERP & supply chain solutions that enable real-time & asynchronous sharing of information and intelligence.

Explosion of social media and user generated content (e.g., wiki) mean that the old-fashioned distinction between the creators (suppliers) of content and consumers (receivers) of content (mostly one-way traffic) has been replaced by two-way flow of information, analysis and intelligence. This has significantly enhanced the voice & visibility of the end customers with a feedback loop. Wrath of an angry customer on social media – mad at the quality of service or products s/he received – can go viral in no time causing significant damage to brand image that takes years to build.

Online shopping (e-commerce) with price-searching BOTs, auctions, commitment to guaranteed “delivery date” and on-line order tracking have radically changed how individuals and corporations procure goods and services. Real-time price determination and on-line promotions based on an individual customer’s history and profile have become standard functionality for the leading on-line retailers like Amazon.

Open source software (e.g., Linux), web browsers (e.g., Google Chrome & Firefox) and services (e.g., Wikipedia) are challenging the proprietary delivery models, platforms and interfaces that supply chain solution vendors developed barely 5-10 years ago. We have also seen the explosion of APPs on the likes of Apple Store and Google Play. Vendors of supply chain execution and planning solutions have followed suit with similar APP markets. This ecology of “smartphones plus web browser based operating systems (OS) plus thousands of APPs” has enabled aggregation of value chain for a given function / activity (e.g., online purchase or competing in games with competitors across the globe).

Just as “desktop OS + client” applications were replaced by “browser + website” over the past 2 decades, “mobile devices + APPs” will soon be replaced by “wearable mobile devices + BOTs”. These BOTs can be programmed to initiate actions as well as respond to “smart messages” from other human or machine users to automate conversations (customer support), transactions (purchasing & shipping) or workflows (within and across business function, such as operations, finance, sales, HR etc). They can also proactively search for exceptions / discrepancies or disruptions in the supply chain and propose or even carry out pre-defined and pre-approved remedial actions.

Internet of Things (IoT), i.e., billions of devices connected via internet and talking to each other, will enlarge the scope of e-commerce and associated supply chain functions from machine-to-human (M2H) and human-to-machine (H2M) interactions to pre-programmed, automated and smart machine-to-machine (M2M) interactions. Vulnerabilities of IoT connected devices have proven to be easily exploitable and will take time to be fully addressed. Most of us have read about the “denial of service” attacks that can take down high-traffic e-commerce sites creating havoc on the net. These coordinated attacks can come in waves with software viruses exploiting loopholes in IoT devices, hijacking them and using them as pawns in a concerted global attack.

Artificial intelligence is enabled by big data, predictive analytics, smarter & flexible algorithms, extensive parallel computing, etc. Its impact on data-driven and automated supply chains is enormous but still has not been fully comprehended. GPS has already gone mainstream in the past decade helping with real time tracking of trucks and containers globally and optimization of shipment routes as well as delivery networks using geo-analytics. Now, GPS enabled devices are complementing other Automatic Identification and Data Capture (AIDC) technologies, such as RFID and bar codes, to make inroads on the smart factory floors and the warehouses.

Visualization by Augmented Reality (AR) and Virtual Reality (VR) and sensors for automatic detection and identification are now increasing their foot print in to our supply chains with applications, such as order picking (“vision picking”) with “smart glass”, autonomous (driver-less) vehicles, shipment deliveries by UAVs / drones and automation of repetitive and physically demanding tasks by robots.

3D printing will dramatically reduce manufacturing lead times and hence have a very significant impact on required inventory to maintain desired service levels. It will also dramatically reduce economic lot size and time to market for many new products.

Voice recognition in varied languages and accents plus translations across multiple languages are further expanding the reach of these innovations in to a far wider user-base than could have been imagined just a decade ago.