SAP EWM Labor Management

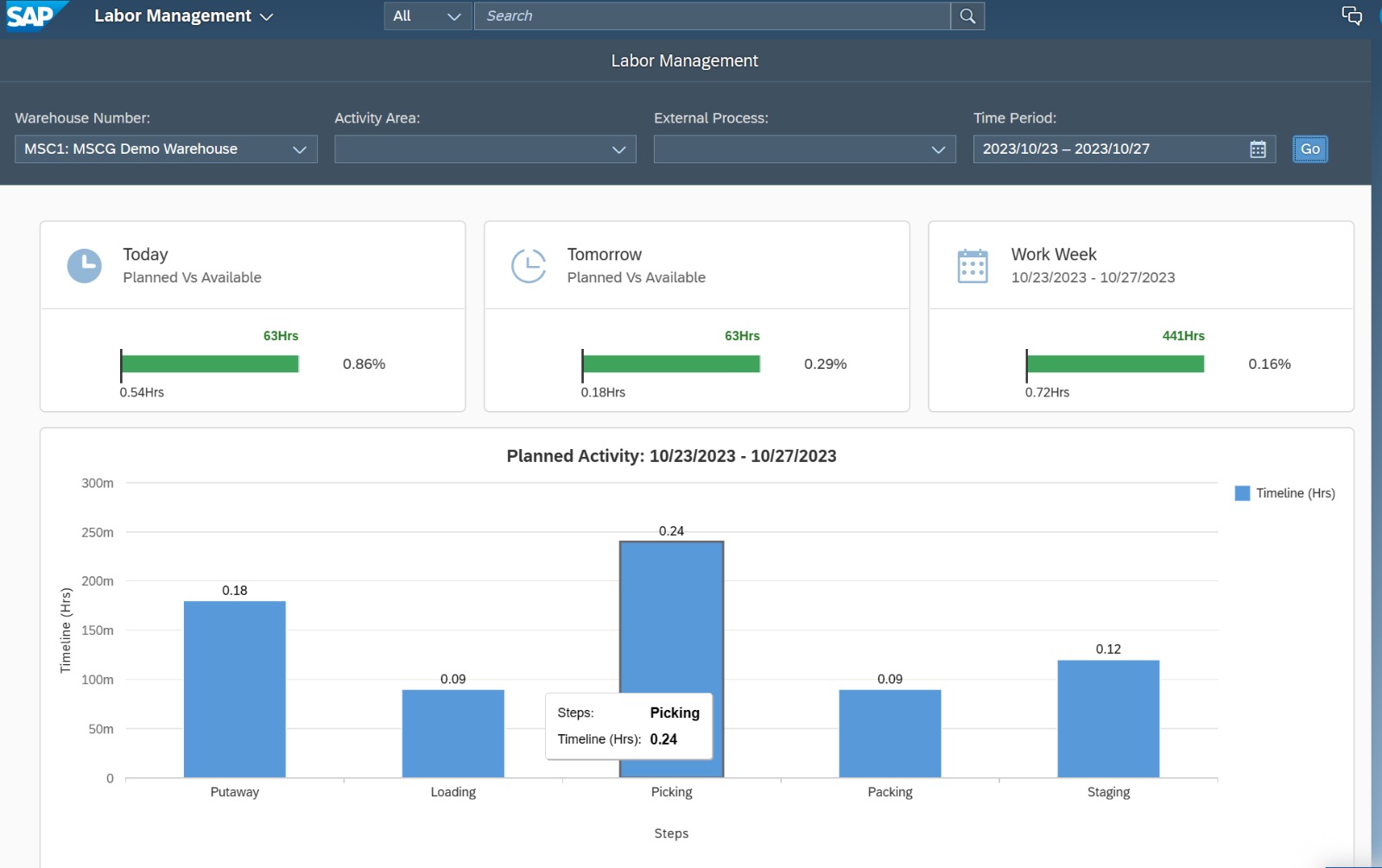

After years of struggling to meet the increased demand for warehousing and distribution center employment, warehouse jobs have recently plummeted to the lowest level in almost a year. In April, the Wall Street Journal reported that U.S. employers slashed 11,800 warehouse and storage jobs from February to March, according to the seasonally adjusted Labor Department preliminary jobs report. Warehousing companies have shed nearly 50,000 jobs since June, when overstocked retailers began trimming inventories due to fluctuating consumer demand. Now, more than ever, tracking of labor utilization with a systematic labor management tool is crucial to ensure operational efficiencies.

How does your facility ensure it maintains proper staffing and equips itself to navigate the volatility in this current environment? Are you actively monitoring and measuring labor utilization to guarantee that you are adequately prepared to handle customer demand? If your answer is “I don’t know” or “No,” then you need to explore the Labor Management capabilities offered within SAP Extended Warehouse Management on S/4HANA Private Cloud Edition.

Labor management in SAP Extended Warehouse Management (EWM) revolves around efficiently coordinating and optimizing labor resources within a warehouse or distribution center. SAP EWM boasts a comprehensive suite of tools and functionalities for managing labor processes, including labor demand forecasting, task assignment, real-time performance monitoring, and labor cost analysis. It empowers organizations to accurately estimate labor requirements for various warehouse operations, allocate tasks based on skills and availability, track workforce productivity in real time, and analyze labor-related costs to enhance decision-making. By harnessing SAP EWM for labor management, businesses can streamline warehouse operations, boost workforce productivity, and ultimately enhance operational efficiency and cost-effectiveness.

They key components and functionality that SAP EWM delivers for labor management include:

Workforce Planning

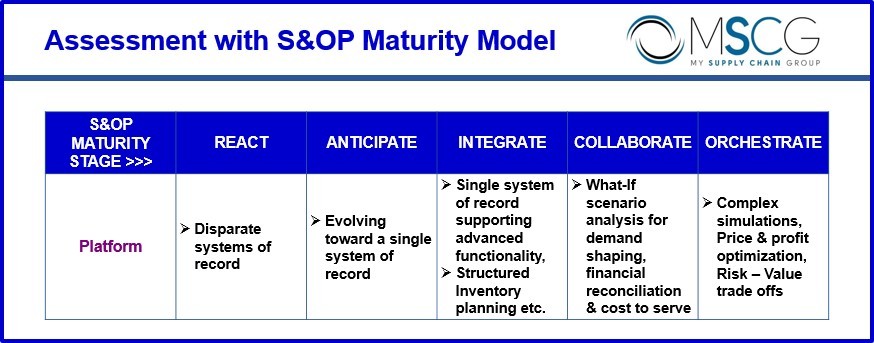

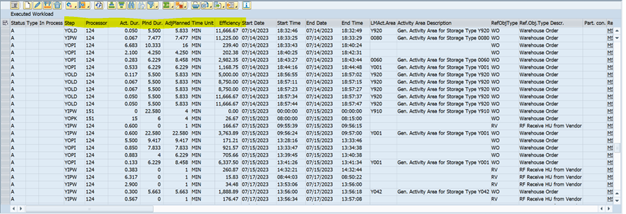

Labor management in SAP EWM enables you to plan and allocate the right amount of labor resources to various tasks and areas within your warehouse. This ensures that you have the appropriate number of workers available to meet your operational demands. The labor management capabilities in SAP EWM, combined with a labor analytics dashboard, offer powerful tools for workforce planning and capacity management.

MSCG Fiori Analytics

Task Assignment

Allocate tasks to individual workers or groups based on their skills, availability, and location. Utilize this functionality in SAP EWM with labor management to ensure that the right people engage in the right tasks at the perfect time.

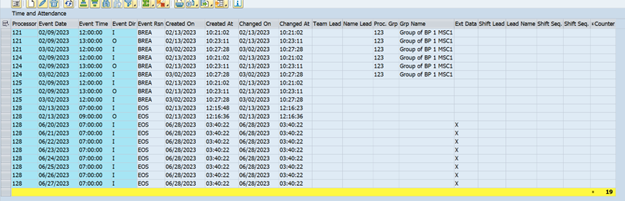

Shift Management

Shift management in SAP Extended Warehouse Management (EWM) is a critical component that allows organizations to define and manage different shifts within their warehouse operations. This functionality assists in scheduling and tracking the work hours of warehouse employees, ensuring efficient task completion while adhering to labor laws and regulations.

Labor Standards

You can establish labor standards for different warehouse activities, such as picking, packing, and shipping. These standards serve as benchmarks for measuring worker productivity and efficiency. You can track task completion speed, identify bottlenecks, and resolve productivity-affecting issues. To perform this calculation, you can indeed use the Business Rule Framework Plus (BRFplus) tool in SAP to define and manage engineered labor standards. Engineered labor standards represent predefined labor time or performance metrics linked to specific tasks or processes within a warehouse or manufacturing environment. These standards serve purposes like performance measurement, labor cost calculation, resource planning, and more.

Labor Management Cost Calculation

By tracking labor hours and performance, you can better manage labor costs and allocate resources more efficiently, ultimately reducing operational expenses.

Indirect Labor Task

Indirect labor tasks refer to tasks that are not directly involved in the physical movement of goods within the warehouse but are essential for the smooth operation of the warehouse. These tasks are often associated with administrative, supervisory, or support functions. Managing indirect labor effectively is crucial for maintaining overall warehouse efficiency and productivity.

Time and Attendance

Time and attendance management in SAP Extended Warehouse Management (EWM) by labor management is crucial for accurately tracking the hours worked by warehouse employees, ensuring compliance with labor regulations, and optimizing workforce productivity.

Operability within Warehouse Processes

You can integrate this functionality throughout business process, such as inventory management, order processing, and transportation management, to establish a seamless and efficient warehouse operation.

Continuous Improvement

With the data and insights gathered through labor management, you can continuously improve your warehouse operations by making informed decisions and implementing process optimizations.

Conclusion

By leveraging labor management in SAP EWM on S/4HANA Private Cloud Edition, businesses will:

- Streamline warehouse operations

- Enhance workforce productivity

- Improve operational efficiency and cost-effectiveness.

Contact My Supply Chain Group for more information – info@mysupplychaingroup.com

Written By:

Wesley Marion Sr. – Sr. Director, Business Development & Innovations

Geeta Fulwani – Sr. EWM Functional